Table of Contents

- Tips & Tricks to Maximizing the Northern Light Health Retirement Plans

- EMHS Retirement Partnership 403(b) Plan

- Affiliated Healthcare Systems Retirement Partnership 401(k) Plan

- EMHS Retirement Partnership Plan & Trust

- Eastern Maine Healthcare Systems 457(b) PLAN

- Developing YOUR Investment Strategy

- Hiring a Financial Advisor - Can One Manage Your Northern Light Retirement Account(s)?

- Getting Ready to Retire? What to consider

- Conclusion

Introduction

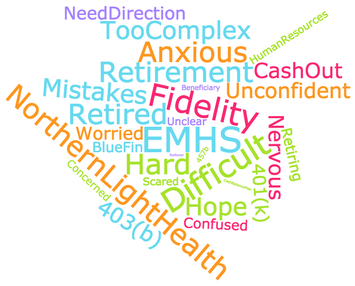

As Financial Consultants at Guidance Point Advisors, LLC and located near most of the locations in the Northern Light Health system, we've had current and former Northern Light Health employees become clients over the years. Additionally, when one of our Consultant's wife, sister-in-law, and close family friends are employees, our team gets very interested in finding better ways to navigate through the retirement plans. Our conversations with clients and friends around the Northern Light Health Retirement Plans can be depicted in the word cloud below. We certainly noticed a pattern of emotional concern that is consistently raised to us.

We thought that if we're able to solve many retirement and financial questions (and ease many of the worries and fears) for our family, friends, and clients that are in the system, then maybe others would benefit from this knowledge. Thus, we thought it was important to create this thorough guide to serve as a one-stop page to many of your questions.

Tips & Tricks to Maximizing the Northern Light Health Retirement Plans

As an Employee of Northern Light Health, you may have one or several retirement plans available to you to maximize your retirement savings. We'll attempt to cover the highlights in addition to the tips and tricks for each plan here, but for more information please refer to the summary plan description for each plan (available to you on your employee intranet page under Human Resources.)

In the first section, we'll cover what each plan is, what are the key features to know, and the tips and tricks of the plan. In section #4, we'll cover strategies to use your plan savings as income when you retire from employment. Please note that since we're covering general features of each plan, there may be provisions directly related to your division that can be different than what is listed in this guide below. Refer to each plan's summary plan description available on the intranet for more information. Use the table of contents on the left if you want to skip directly to any section.

EMHS Retirement Partnership 403(b) Plan

WHAT IS IT?:

WHAT IS IT?:

- A 403(b) Plan is a retirement plan for certain employees of tax-exempt organizations.

- In 2025, employees are eligible to contribute $23,500 of their employment earnings and another $7,500 of catch-up contributions if they are over age 50.

- Most of the member organizations of Northern Light Health are eligible to participate under this 403(b) retirement plan. Member organizations ineligible for this plan would be allowed to contribute to the Affiliated Healthcare Systems Retirement Partnership 401(k) Plan instead.

WHAT ARE THE FEATURES TO KNOW?:

WHAT ARE THE FEATURES TO KNOW?:

- You can contribute to the plan immediately upon hire. This is great as many organizations may make you wait a year before you can contribute to a retirement plan (meaning you would lose a year towards saving for your retirement.)

- Once eligible, the company provides a match of 50% up to 4% of your contribution (i.e. if you contribute 4%, the company matches 2%.) However, note that the match doesn't start until you've reached age 21, obtained one year of service, and with a semi-annual entry date (you would start receiving the match on the first day of the first or seventh month upon achieving the two previous requirements.)

- There's a 3-year cliff vesting feature meaning if you work for Northern Light Health less than 3 years, you will forfeit any Employer match (and their associated earnings) deposited into the account. You will always own your own contributions and earnings.

- This plan has automatic enrollment. This means that unless you tell your employer you DON'T want to participate in the plan, you'll be automatically enrolled in the plan with a contribution rate of 3% of your salary.

TIPS AND TRICKS:

TIPS AND TRICKS:

- If you've been an employee for longer than a year, were automatically enrolled in the plan, and you're still contributing the default 3% into the plan - you're not receiving the full employer match! You're leaving free money from your employer on the table. Up your contribution from 3% to 4% to get the full 2% match!

- If you don't like the investment choices available to you in this plan, you have a "Self-Directed Brokerage" (SDB) option available to you. Within this plan, you can use the SDB to access most mutual funds in the investment world.1 Also, you can use the SDB to allow a Financial Advisor to professionally manage your retirement money for you! (see section #3).

- The plan has a Roth deferral feature. This is an after-tax contribution, which means you must pay current income tax on your contribution to the plan. Since you have already paid tax on the deferral, you won't pay tax on it again when you receive a distribution from your Roth money in retirement. However, please note if you are contributing to the plan via Roth your employer match is still being contributed to your account as a pre-tax contribution, not after-tax.

- The plan does allow for an "in-plan Roth conversion". This means you can convert some or all of your pre-tax retirement account into a Roth account. Unfortunately, this isn't as easy as it sounds. You can't use your money in the retirement account to pay the associated taxes of the conversion. So you must use out-of-pocket funds to pay the associated tax bill. Ouch! Also, if you continue to be employed and contribute to the plan, your matching contributions from the company will still be pre-tax. You'll have to continue to convert these funds to Roth over time if you'd like to have 100% of your funds as after-tax retirement assets.

- Take a loan from your retirement account as a last resort, or just don't do it! Why? First, your retirement savings should just be for retirement. Using these funds earlier robs your savings of compounding and the missed savings that instead go towards paying back your retirement account. Second, your retirement account is generally saved on a pre-tax basis. When you pay back a loan, you're paying yourself back with after-tax dollars into a pre-tax account. Of course, when you go to withdraw from this retirement account in retirement, any withdrawals are then taxed as income. In regards to your loan, you've now paid taxes twice on that money. If you're like us, we don't enjoy paying taxes the first time, much less twice on the same funds!

Affiliated Healthcare Systems Retirement Partnership 401(k) Plan

WHAT IS IT?:

WHAT IS IT?:

- A 401(k) plan is a retirement plan for certain employees of for-profit organizations.

- In 2025, employees are eligible to contribute $23,500 of their employment earnings and another $7,500 of catch-up contributions if they are over age 50.

- Only the following Northern Light Health members: Affiliated Laboratory, Affiliated Healthcare Management, Beacon Health, Meridian Mobile Health, and Miller Drug are eligible to contribute to this plan.

WHAT ARE THE FEATURES TO KNOW?:

WHAT ARE THE FEATURES TO KNOW?:

- You can contribute to the plan immediately upon hire. This is great as many organizations may make you wait a year before you can contribute to a retirement plan (meaning you would lose a year towards saving for your retirement.)

- Once eligible, the company provides a match of 50% up to 4% of your contribution (i.e. if you contribute 4%, the company matches 2%.) However, note that the match doesn't start until you've reached age 21, obtained one year of service, and with a semi-annual entry date (you would start receiving the match on the first day of the first or seventh month upon achieving the two previous requirements.)

- There's a 3-year cliff vesting feature. This means if you work for Northern Light Health less than 3 years, you will forfeit any employer match (and their associated earnings) deposited into the account. You will always own your own contributions and their earnings.

- This plan has automatic enrollment. This means that unless you tell your employer you DON'T want to participate in the plan, you'll be automatically enrolled in the plan with a contribution rate of 3% of your salary.

TIPS AND TRICKS:

TIPS AND TRICKS:

- If you've been an employee for longer than a year, were automatically enrolled in the plan, and you're still contributing the default 3% into the plan - you're not receiving the full employer match! You're leaving free money from your employer on the table. Up your contribution from 3% to 4% to get the full 2% match!

- If you don't like the investment choices available to you in this plan, you have a "Self-Directed Brokerage" (SDB) option available to you. Within this plan, you can use the SDB to access most investments in the investment world2 (NOTE: unlike the 403(b), you're able to buy individual stocks or bonds in the 401(k) SDB.) Also, you can use the SDB to allow a Financial Advisor to professionally manage your retirement money for you! (See section #3).

- The plan has a Roth deferral feature. This is an after-tax contribution, which means you must pay current income tax on your contribution to the plan. Since you have already paid tax on the deferral, you won't pay tax on it again when you receive a distribution from your Roth money in retirement. However, please note if you are contributing to the plan via Roth your employer match is still being contributed to your account as a pre-tax contribution, not after-tax.

- The plan does allow for an "in-plan Roth conversion". This means you can convert some or all of your pre-tax retirement account into a Roth account. Unfortunately, this isn't as easy as it sounds. You can't use your money in the retirement account to pay the associated taxes of the conversion. So you must use out-of-pocket funds to pay the associated tax bill. Ouch! Also, if you continue to be employed and contribute to the plan, your matching contributions from the company will still be pre-tax. You'll have to continue to convert these funds to Roth over time if you'd like to have 100% of your funds as after-tax retirement assets.

- Take a loan from your retirement account as a last resort, or just don't do it! Why? First, your retirement savings should just be for retirement. Using these funds earlier robs your savings of compounding and the missed savings that instead go towards paying back your retirement account. Second, your retirement account is generally saved on a pre-tax basis. When you pay back a loan, you're paying yourself back with after-tax dollars into a pre-tax account. Of course, when you go to withdraw from this retirement account in retirement, any withdrawals are then taxed as income. In regards to your loan, you've now paid taxes twice on that money. If you're like us, we don't enjoy paying taxes the first time, much less twice on the same funds!

EMHS Retirement Partnership Plan & Trust

WHAT IS IT?:

WHAT IS IT?:

- The Plan is a "defined-benefit cash balance plan in which your accrued benefit at any point in time is determined by reference to your Cash Balance account" (Source: Summary Plan Description Page One.) What does that mean in a language I can understand? This is a plan that Northern Light Health contributes to and invests on your behalf. You do not have the ability to save money from your income into this plan. You can see how much has been put into the account and its earnings by looking at the balance of your account.

- Contributions by Northern Light Health don't start until you've reached age 21, obtained one year of service (1,000 hours worked), and with a semi-annual entry date (you would start receiving the match on the first day of the first or seventh month upon achieving the two previous requirements.)

- Most, but not all divisions are eligible to participate in this plan ~ please check your summary plan description to see if you are eligible.

WHAT ARE THE FEATURES TO KNOW?:

WHAT ARE THE FEATURES TO KNOW?:

- How much is Northern Light Health contributing to this plan on my behalf? For each plan year where you worked 1,000 hours of service (or more), your account will be credited with a percentage of your total pay under the following schedule:

The sum of your whole years of age & credited service as of 12/31 equals: Percentage Contribution by NLH: Less than 41 3% 41, but less than 51 4% 51, but less than 61 5% 61, but less than 71 6% 71, but less than 81 7% 81 or more 8% - You don't get to choose how this plan is invested for you. An investment committee is overseeing the investments of this plan. Interest credits are applied to your cash balance account on a daily basis and continue until you receive payments from the plan. Interest is applied at the greater of a 4.50% rate or the average yield to maturity on 1-year treasury bills.

- This plan used to be record kept at Fidelity. When you logged into your Fidelity account previous to 2017, you would see your 403(b) or 401(k) account AND the balance of this account. In 2018, Bluefin became the record keeper of this plan, so you'll have to login to both Fidelity and Bluefin to see your entire retirement accounts' balances.

TIPS AND TRICKS:

TIPS AND TRICKS:

- Every now and again we do hear of an employee that is dissatisfied with the level of match provided in the 403(b) and 401(k) plan. We remind them that its important to look at the level of contribution given to you from this Cash Balance Plan plus your 403(b) or 401(k). The majority of employers give a 4% match if you contribute 5% of your pay. In this case, a new and younger employee would get 3% from the Cash Balance, plus a 2% match if they contribute 4%, so giving 4% of your own pay and receiving 5% is actually more favorable to you!

- There are many things to think about when looking to take money out of this plan when you retire or sever employment. Read section #4 for those tips!

Eastern Maine Healthcare Systems 457(b) PLAN

WHAT IS IT?:

WHAT IS IT?:

A 457(b) Plan is a retirement plan for certain employees of non-government organizations. It's generally used a supplemental savings plan for employees that want to save more pre-tax funds into retirement accounts than what is allowed into their 403(b) or 401(k).

- To be eligible for this plan you must be one of the following classes of employees:

- A physician

- An executive employee with a base salary of at least $150,000

- An independent contractor with a base salary of at least $150,000 that is deemed by the organization as being eligible to participate in this plan.

WHAT ARE THE FEATURES TO KNOW?:

WHAT ARE THE FEATURES TO KNOW?:

- Money deferred into non-governmental 457 plans may not be rolled into any other type of tax-deferred retirement plan. It may be rolled only into another non-governmental 457 plan. (Source: Wikipedia)

- Money deferred into non-governmental plans is not set aside in a trust for the exclusive benefit of the employee making the deferral. The Internal Revenue Code requires that money in a non-governmental 457 plan remains the property of the employer and not taxable until time of distribution for specific situations as allowed by the original 457 plan or in cases of withdrawals for emergency cash needed situations. (Source: Wikipedia)

- Your investment choices are similar to what is offered in other Northern Light Health retirement plans.

TIPS AND TRICKS:

TIPS AND TRICKS:

- As an employee deferring funds into this 457(b) plan, you must consider the risk if Northern Light Health enters bankruptcy and your retirement funds in this plan are no longer available to you. With any 457(b) plan, make sure to monitor the strength of the employer's credit ratings and whether they are rated as "Investment Grade" or "Speculative Grade." Speculative Grade credit ratings mean they have a greater risk of bankruptcy and your 457(b) plan savings have risk of not being there when needed.

- Due to the risk of forfeiture, or loss of this account, if Northern Light Health should enter bankruptcy, employees should ensure they are maximizing their savings into the 403(b) or 401(k) first before saving into this plan. Additionally, if you have a spouse you may want to consider maximizing your retirement savings into their 401(k) or 403(b) next before considering saving into the 457(b) plan.

Now that you know how to save in each of these plans, how should you consider investing in each of the plans? This is where many folks feel like this:

If the investment side of the equation is giving you some trouble, read on to section 2 ~ Developing YOUR Investment Strategy.

Developing YOUR Investment Strategy

I now know about how to save in the Northern Light Health retirement plans, but how should I invest in them?

![]() Step One: Make an estimate at your realistic ideal for retirement income.

Step One: Make an estimate at your realistic ideal for retirement income.

Start by making a budget of necessary living costs (housing, utilities, car, groceries, medical insurance, etc.) that you could reasonably estimate but in today's dollars. Say that you think it might cost you approximately $80,000 in required living costs, but you want to also have another $20,000 in discretionary costs for items such as vacations and dining. Adding these two items together, you'd need $80,000 in living expenses, but would ideally like $100,000 to spend per year in today's dollars.

![]() Step Two: How much of your retirement income will need to come from your retirement savings?

Step Two: How much of your retirement income will need to come from your retirement savings?

Estimating any payments from Social Security and pensions from other employers or state governments will allow you to find your retirement foundation. For example, if you and your spouse each will receive a $25,000 social security benefit at age 67, you have a base of $50,000 income to consider for retirement. Taking the example in Step One further, if you need $100,000 per year and you're due to receive $50,000 in Social Security income, you now need to establish enough savings over your career to allow for $30,000 to $50,000 per year of expenses. We've recently written a blog post that can assist you on whether you're on the right path to that spending level. Check it out here!

If you have fully funded your retirement income needs, then you may want to consider protecting your nest egg more against risk of loss, especially as you get closer to retirement. If you are not on pace for your retirement goal, then considering retiring a bit later than planned, increasing your savings into the retirement plan, and/or changing your investment strategy should be investigated.

You can also use the following retirement income calculators to get a bit more specific to your situation: this one from Vanguard, and this one from Dimensional Fund Advisors (DFA.)

![]() Step Three: Measure your risk tolerance, your ability to save for retirement, and a target rate of return to achieve your goal.

Step Three: Measure your risk tolerance, your ability to save for retirement, and a target rate of return to achieve your goal.

Now that it's a bit more clear on what we're trying to accomplish, it's time to generate a plan for how we'll accomplish this goal. The first thing to measure is your willingness to accept risk and capacity to take risk. There's some simple tools out there you can use, including this one from Vanguard.com. The premise is that if you're not able to emotionally accept that there may be times that you can lose in stocks, then it might point you to investing in less risky investments such as bonds or cash. With less risky investments, your money may not grow by as much and with less speed. This may mean that you need to save more for retirement to make up any gains you sacrifice by being less risky.

Many financial planners suggest saving 10% to 15% of your pre-tax income into your retirement accounts to fully fund your retirement over time. The previously listed calculators can demonstrate to you the impact of saving at different percentages of your pay. However, you also do need to live for today, so carefully budgeting what you can afford to save is an important step to balance both today and your retirement.

![]() Step Four: Invest!

Step Four: Invest!

Step Four is the part where most people just say "yeah, yeah, yeah" to Steps One through Three, and let's skip to Step Four. Unfortunately that can be a bit short-sighted like driving a car without knowing where you're going. Why would I invest funds if I haven't gone through the practice of goal-setting and knowing, albeit roughly, where I'm likely to be headed?

While many employees find the investing part fun, or confusing, or even difficult, our team finds that most employees don't really know why they're investing.

While many employees find the investing part fun, or confusing, or even difficult, our team finds that most employees don't really know why they're investing.

The principle is to achieve the rate of return that allows you to meet or exceed your retirement income goals. You'll notice in the previous steps when using retirement calculators, they ask you for an assumed investment rate of return. This is where your investments come into place. If you need a 6% rate of return to achieve your retirement income goals, then you'll need to be aligning your investments to meet or exceed a 6% return goal over the course of your career.

So in what do I invest to achieve my goal rate of return? Unfortunately, it would not be prudent for us to provide you with broad investment advice since not all client needs and circumstances are the same. However, we're pleased to report to you that the Northern Light Health Investment Committee is doing a great job continuing to negotiate lower investment costs for your investment options and providing plenty of options available to you in these plans to craft a tailored investment strategy to achieve your investment goals.

![]() Step Five: Can I do this all by myself?

Step Five: Can I do this all by myself?

The answer is that some people have what we like to call the "TWA" to be successful in saving for their retirement solo. "T" stands for time. Do you have the time to spend self-educating best practices and how to invest your funds? "W" stands for willingness. If you find mapping out the process and staying on top of your investable assets work and not fun, you might not have the willingness to do this work yourself. Lastly, "A" is for attitude. Over the course of your career, you'll need to have a steady attitude in order to not self-sabotage your retirement. Sticking to your plan and how you are investing in your plan will put you in a better position to succeed than making emotional decisions based on fear and greed.

But after reading all this information are you overwhelmed?

If you don't think you have the TWA to do this alone, you can always talk to a Fidelity & Bluefin representative that can assist in your plan. However, you may want to consider hiring a dedicated Financial Advisor to work with you. There's even Financial Advisors out there that can manage your money within the Northern Light Health retirement plans. Read chapter 3 for more information on how to do this!

Hiring a Financial Advisor - Can One Manage Your Northern Light Retirement Account(s)?

Can a Financial Advisor manage my retirement assets in the Northern Light Health Retirement Plan without requiring me to leave my job or rollover my retirement plan savings?

The short answer is, "Yes!". This is a big deal. Why?

Well, generally people don't have enough savings to hire a fiduciary Financial Advisor unless they are working with a broker that charges on a commission basis to the investor. By allowing a fiduciary advisor to manage your Northern Light Health retirement account, you may get access to more advanced services from a fiduciary Financial Advisor that you wouldn't otherwise receive (for example: robust financial planning, oversight of all your assets, estate planning discussions, risk and insurance assessments, etc.)

How does this work? Within the Northern Light Health retirement plans on the Fidelity platform, one of the investment options is called a "Self-Directed Brokerage" program. There are a number of advisors in your local area who custody their clients' assets with Fidelity directly and are able to advise on clients assets in this Brokerage program. Guidance Point Advisors is one of these advisors. A few things to note about the Advisor working with the assets in this Brokerage program:

- Only employee and employer contributions are available to be invested by a Financial Advisor in the SDB, not the EMHS Retirement Partnership Plan assets.

- The Financial Advisor's fees are eligible to be deducted from your retirement plan account directly. This means that you won't have to write an out-of-pocket check on a quarterly basis to pay for the Financial Advisor's services.

- This SDB portal in the EMHS 403(b) plan is restricted to only allow mutual fund transactions and not specific stocks, bonds, options or other instruments the Financial Advisor may ordinarily use in their client money management. The SDB portal in the Affiliated Healthcare Systems Retirement Partnership 401(k) does not restrict the investment options available to you.

I've decided I want to hire a Financial Advisor to help with my retirement accounts. First, you should understand the basics: Fiduciary vs. Suitability - What's the difference?

In the medical profession, each physician takes the Hippocratic Oath or to “do no harm permanently.” In the legal profession, attorneys abide by the ethical rules of the jurisdiction they practice within, but what about your Financial Advisor? Financial advisors are held to one of two different standards depending on whether you are working with a fiduciary or a broker-dealer. While the title “Financial Advisor” may apply to both, there are differences that you should be aware of. The major distinction is whether your advisor is considered by the government as an investment advisor or an investment broker. Each is held to a different set of standards. See this link to learn more.

The Fiduciary Standard applies to investment advisors while the Suitability rule applies to an investment broker. From Investopedia: Investment advisors, who are usually fee-based, are bound to a fiduciary standard that was established as part of the Investment Advisors Act of 1940. They can be regulated by the SEC or state securities regulators. The act is pretty specific in defining what a fiduciary means, and it stipulates that an advisor must place his or her interests below that of the client. It consists of a duty of loyalty and care, and simply means that the advisor must act in the best interest of his or her client.

Broker-dealers only have to fulfill a suitability obligation which is defined as making recommendations that are consistent with the best interests of the underlying customer. Broker-dealers are regulated by the Financial Industry Regulatory Authority (FINRA) under standards that require them to make suitable recommendations to their clients. Instead of having to place his or her interests below that of the client, the suitability standard only details that the broker-dealer has to reasonably believe that any recommendations made are suitable for clients, in terms of the client's financial needs, objectives and unique circumstances. A key distinction in terms of loyalty is also important, in that a broker's duty is to the broker-dealer he or she works for, not necessarily the client served. This can quickly lead to advice that is filled with potential conflicts of interest, thus, it can be hard to trust the advice of a Financial Advisor working on a commission basis. Can you imagine if a medical professional or legal professional had a duty to the employer they worked for and not necessarily in the best interest of the patient or a client? Would joint replacements be done just because the physician needed more billable surgery and not because it was medically necessary? Terrifying.

This is the very first thing to understand when searching for a Financial Advisor to hire. So fiduciary or broker? How do you, the consumer, start to figure out which standard your advisor is held to? It’s not easy. Many Financial Advisors can be both an investment advisor AND an investment broker so there may be sometimes when one applies the fiduciary standard and then in the same conversation or meeting applies the suitability standard. The easiest way to find this out is to start asking about how the Financial Advisor is paid, or simply follow the money!

Here’s some questions to ask any potential Financial Advisor:

- Do you accept your fiduciary status in writing when investing your clients’ money?

- Do you get paid anything (commissions, gifts, vacations, perks, sporting event tickets, etc.) due to the recommendations you give your clients?

- How do you get paid, or how are you compensated?

- Do you sell products such as life insurance, annuities, private real estate placements, or anything else?

- Will you disclose any potential conflicts of interest?

- What licenses or credentials do you have? (Do you have a securities license or an insurance license? Do you have a license to give financial advice?)

- For more questions, please refer to the SEC's investor bulletin here.

At Guidance Point Advisors, our Investment Consultants adhere to the The Fiduciary Standard. We are all bound to put our clients needs above our own and it is something that we take very seriously not just because we have to, but because we want to. Is your current or future Financial Advisor putting your needs first?

I've decided I want to hire a Financial Advisor to help with my retirement accounts. Second, How do I shop for and select the best Financial Advisor for me?

Are you considering hiring a Financial Advisor, but you don’t know how to get started? There are so many things to consider when hiring a Financial Advisor, but let’s start with the basics.

Are you considering hiring a Financial Advisor, but you don’t know how to get started? There are so many things to consider when hiring a Financial Advisor, but let’s start with the basics.

To find a list of Financial Advisors regulated by the U.S. Securities and Exchange Commission, check out our blog here that details this process step by step.

After making your list of potential advisors from the information that you have gathered, start scheduling interviews. Make a list of questions and be sure to cover any concerns that you have. Don’t be afraid to ask a lot of questions, this is a job interview!

Choosing a Financial Advisor is very personal. Everyone has different needs, and there is no "one size fits all" option. Whoever you choose, make sure that you do your homework. It's ok to be picky! If you’re going to trust someone to handle your nest egg, you want to make sure that you’re hiring the very best person for the job. You may want to also read our blog "Top 5 Problems with Financial Advisors and How to Solve Them" for more information.

I've decided I want to hire a Financial Advisor to help with my retirement accounts. Third, what is the cost to hire a Financial Advisor and how do I know if I'm paying too much?

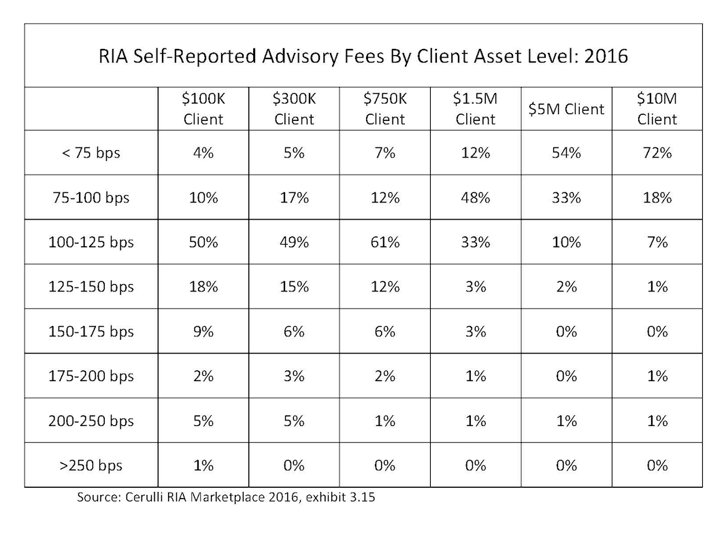

Getting past other differentiators, say you’re close to hiring your Financial Advisor, and you really can’t decide between the two as you equally like and agree with both firms / advisors. Then in this case, a decision can truly come down to price. This is where it can get pretty difficult. Where would you go to compare investment advisors’ fees? Unfortunately, there isn’t an Edmunds.com or Kelley Blue Book like when you’re buying a car that you can use to guide you to what an appropriate price would be. Also, advisor fees usually “wedding cake” or get cheaper the more investable assets you place with them. Below you can see 2016 Self-Reported Advisory Fees for Registered Investment Advisors by Client Asset Level. This comes from Cerulli’s RIA Marketplace 2016 study, Exhibit 3.15

A few things to help you read this table. First, the first column is listed as bps, or basis points. A basis point is 0.01%. 75 bps would be interpreted as 0.75%. The $100k client reads as a client that has $100,000 of investable assets, and the “M” stands for million ($1.5 million in investable assets). The percentages are the percentage of Registered Investment Advisory (RIA) firms that charge the fee level for the client segment. So 4% of RIA’s charge a fee of less than 0.75% for clients with less than $100,000 investable assets

What are a few key takeaways from this table?

- For $300,000 of investable asset clients, 71% of them pay less than 1.25% in advisor fees and this number jumps to 80% for $750,000 clients.

- The majority of clients with $1,500,000 pay 1.00% or less in advisor fees.

- The majority of clients with $5,000,000 and $10,000,000 in assets pay less than 0.75%.

A few caveats to pricing (aren’t there always?). There are very few resources, even to us as Financial Advisors, to benchmark prices and practices. These prices are based on asset based pricing, or fees that increase or decrease based on the level of assets that are placed with the advisor . Please note that this study is as of 2016 and probably won’t be updated in this blog post going forward, so pricing data is getting more stale by the day.

It is important to know if there are other Financial Advisor fees involved such as commissions paid to the advisor, fixed fees, or fees for service. You certainly don’t want to receive a hidden fee later that was never discussed but probably was disclosed in account agreements, marketing brochures, or other disclosures.

Our firm thinks in profitability based on the amount of time we’re spending with our clients, and our fees are reflective of that service level. A client that needs a higher or lower service level than proposed should be expected to impact the quoted fee. You can research more of our firms pricing with this link here.

Ultimately, the Financial Advisor fee is a social agreement about what a reasonable price is for the services delivered and by whom its delivered. Why does no one talk about this? Well, knowledge is power. If you don’t know what the price truly is, if you don’t know what it should be, if you don’t know that the price can probably be negotiated then you accept what is given to you. Clients should be in control of what they pay from their nest egg and to whom. Isn’t it ironic that the role of the Financial Advisor is to help you take control over your finances and better educate you on your money, but may not have a truly open and honest conversation about fees?

Many investment advisory firms are used to advisory fees at or above a 1.00% level and their practice and personal lifestyles are adjusted to these fees. Anecdotally from our personal experience, there’s a resistance to lowering fees within the industry as it means laying off support staff, downgrading office space and prestige, and worse case to the advisor – taking less pay. Maybe Financial Advisor fees will start to decline due to more awareness from clients and the client knowledge about the advisor’s fiduciary status. Will advisors just start cutting their product costs (using less expensive investments) to achieve goals and show the client cost savings? You can read more on this topic from our blog titled Financial Advisor Fees: Am I Paying Too Much? here.

Getting Ready to Retire? What to consider!

Congratulations on your Retirement Decision! What are your options?

Many of our years of conversations with Northern Light Health employees have been focused on fear of "how does retirement work?", "how do I make sure I'm not making a mistake in retirement; I've never been retired before!?", and "am I really ready to retire?" I think most retirees don't want to make a mistake and fail, kind of like this poor cat!

Many of our years of conversations with Northern Light Health employees have been focused on fear of "how does retirement work?", "how do I make sure I'm not making a mistake in retirement; I've never been retired before!?", and "am I really ready to retire?" I think most retirees don't want to make a mistake and fail, kind of like this poor cat!

Below are some general things to know that are consistent for both the EMHS Retirement Partnership 403(b) Plan and Affiliated Healthcare Systems Retirement Partnership 401(k) Plan.

Keep the following in mind:

- If you have more than $7,000 in your Northern Light Health Retirement account, you're allowed to keep your retirement money in the plan. You can process Required Minimum Distributions directly from the plan once you reach age 70.5.

- Upon retiring or terminating, you can rollover your entire retirement account into an Individual Retirement Account (IRA) in order to retain the retirement status. If you have both pre-tax money and ROTH (after-tax) retirement accounts, it may mean you need two distributions from the plan into two IRAs. If you're working with a Financial Advisor, you'll want to consult with them on this step of opening up IRA(s) before you process your distribution from the plan.

- You have the option to take only a partial withdrawal of your funds in your plan.

- Installment distributions are also an option. For example, if you had $10,000 in the plan, you could ask the plan to distribute $100 per month for the next 100 months.

- A 403(a) annuity is available - you can read more about 403(a) options here.

- Cash Distribution - this is generally the least popular option as your entire retirement account, if pre-tax, becomes taxable immediately and can increase the amount of taxes due versus if you took installments from your account over time.

- Make sure your beneficiary designation is always up to date. Each individual plan that you are participating in needs to have its own beneficiary designation. If you pass away, your beneficiary will have the ability to have more control over when taxes get applied to their inheritance instead of flowing directly to your estate and all becoming taxable at the same time. The beneficiary designation supersedes your will, so if you become divorced, remarried or your attitude about your estate changes, you'll want to make sure these documents are continually updated. We've seen enough situations when ex-spouses are left retirement accounts and insurance policies because a beneficiary designation was not updated. This can cause messy court battles and family dynamics.

![]() What about my money in the EMHS Retirement Partnership Plan and Trust Agreement?

What about my money in the EMHS Retirement Partnership Plan and Trust Agreement?

- When you terminate from service for any reason, if you have completed 3 years of service and reached age 65 or become disabled or die, you're eligible to receive the actuarial equivalent of your cash balance account.

- Normal Retirement Date, or the date when you're eligible to withdraw money from this plan, is defined as the "first day of the month following attainment of the age at which unreduced Social Security Retirement benefits may begin. This date will depend on your date of birth."

- This plan also allows in-service withdrawals, meaning you can be working and upon reaching age 62, distribute funds to you and still receive annual contribution credit and interest credits.

- You have several options to you to withdraw the funds from this plan:

- The primary form of payment is joint and survivor annuity. This means you and your surviving spouse will receive a monthly payment during your joint lives.

- If you give the Plan Administrator at least 90 days notice prior to when benefits would commence, you can also elect a lump sum payment (this is eligible to rolled over to an IRA or another retirement plan), 5 or 10 year installment benefit, a lifetime annuity, a qualified optional survivor annuity, or a 10-year certain and contingent benefit. Well ahead of the 90 day period (perhaps years), we'd urge you to connect with your dedicated Northern Light Health Human Resources representative to better understand all your options.

![]() I also have money in the Eastern Maine Healthcare Systems 457(b) Plan? How do I take money from this plan?

I also have money in the Eastern Maine Healthcare Systems 457(b) Plan? How do I take money from this plan?

- When you become eligible to receive benefits (upon severance from employment and age 65), the primary form of distribution from your 457(b) plan is a single lump sum. This may be problematic as you'll be getting one payment that immediately is taxable as income to you.

- If you don't want to receive a lump sum, then within 30 days prior when you would receive your 457(b) benefit you'll need to deliver a written election to the Plan Administrator that indicates how you'll want to receive your benefit. This includes the following options:

- Monthly, quarterly, or annual installments over at least a 10 year period or your life expectancy. For example, if a participant wants annual installments over 10 years, this generally works by taking 1/10th of your account balance the first year, 1/9th the second year and so on. Please keep in mind the risk of forfeiture from the sponsoring entity is still in place over the time period you select.

- In a lump sum on a fixed or determinable date (but keep in mind IRS regulations on when you are required to take pre tax distributions such as Required Minimum Distributions.) This option essentially gives you the ability to take a lump sum of your benefit when it may be more tax advantageous for you to do so.

- In a fixed dollar amount to be paid in bi-weekly, semi-monthly, monthly, quarterly, semi-annual, or annual installments over at least a 10 year period or your life expectancy. Please keep in mind the risk of forfeiture from the sponsoring entity is still in place over the time period you select.

- If you leave employment before you are eligible to receive benefits, you may be able to roll over your Eastern Maine Healthcare Systems 457(b) plan to your next employer. This is provided that your next employer also has a 457(b) plan and accepts rollovers from other 457(b) plans. You'll need to provide written notice to the Plan Administrator in order to take advantage of this option.

PHEW!

That is a lot of information! It's pretty complex to navigate through all the different retirement plans available to you at Northern Light Health. If you want a copy of this page you can take with you, please fill out the form below to download a .pdf eBook version of this information. In the meantime, bookmark this page in case you have future questions and check out the following videos that can help you learn a bit more about saving for retirement in company sponsored retirement plans.

Frontline: The Retirement Gamble

(aired April 22, 2013)

Last Week Tonight with John Oliver: Retirement Plans

(aired June 12, 2016) - Warning: Not Safe For Work (NSFW)

Disclosures:

1,2. The Self-Directed Brokerage program contains multiple share classes of the same fund. Note that expense ratios will vary among share classes.

Get Started on Maximizing Your Northern Light Health Retirement Today.

Simply fill out this form to receive a PDF version of this guide.

Yes, send me the complimentary ebook!

Ever done a Google search for the Northern Light Health Retirement Plans, and you found the majority of the answers to your questions in one place? Us neither. Why is that? Our team at Guidance Point Advisors wanted to put together a guide to help the Employees at Northern Light Health and their affiliates on best using the resources of the Northern Light Health Retirement Plans and local experts to solve YOUR retirement needs. We hope you find this Guide a great first step in Maximizing Your Retirement ~ starting today.

Benjamin Smith, CFA

Benjamin Smith, CFA

Guidance Point Advisors, LLC.

When working on Northern Light Health Employees' Financial Plans over the past several years, we've continually seen themes and questions that are distinctly unique to the Physicians, Administration, Nurses, and Employees of the Northern Light Health System. Hopefully, this guide serves as your one stop for helping you navigate through similar questions that we've assisted in answering!

Curtis Worcester

Curtis Worcester

Guidance Point Advisors, LLC.